Do You Feel Like Your Identity Has Been Stolen?

Is It Possible That Your Identity Has Been Stolen?

Unfamiliar accounts appear on your credit report. Debt collectors call about purchases you didn’t make. Strange transactions drain your bank account, while credit card offers you never requested pile up in your mailbox.

These are all warning signs that your identity might have been stolen.

If you’re facing these issues, you’re not alone. Identity theft is a growing problem, and it can take a serious toll on your financial well-being and mental health. But don’t panic, there are steps you can take to protect yourself and recover. Understanding the signs of identity theft and acting quickly is key to minimizing the damage.

Common Signs Your Identity Has Been Stolen

Unexpected Credit Inquiries: If you see unfamiliar accounts or inquiries on your credit report, someone may have opened accounts in your name. These unauthorized credit checks are a red flag for identity theft.

Debt Collectors Contacting You: Receiving calls from debt collectors about purchases or loans you didn’t make is a major sign that your personal information has been used by someone else.

Unauthorized Bank Transactions: Missing funds or unfamiliar transactions in your bank account may mean your bank details have been compromised and used by fraudsters.

Credit Card Offers You Didn’t Apply For: Receiving credit card offers you didn’t request could indicate that someone has opened a new account in your name or applied for credit using your identity.

The Importance of Identity Theft Protection:

Identity theft can cause long-lasting financial harm, damage your credit score, and take years to fully resolve. When someone uses your personal information without your consent, it’s not just an inconvenience, it’s a serious violation. By investing in identity theft protection, you can monitor your financial accounts, receive alerts about suspicious activity, and get help if your identity is compromised.

Protection services typically include:

Credit Monitoring: Alerts you to any changes or suspicious activity in your credit report. Fraud Alerts: Notifies you if an attempt has been made to open a new account in your name.

Recovery Assistance: Provides support to help you resolve issues if your identity is stolen.

Identity Theft Insurance: Covers the costs of recovering your stolen identity, including legal fees and lost wages.

What to Do If You Think Your Identity Has Been Stolen

If you suspect that your identity has been stolen, it’s important to act fast. Here are the steps you should take:

– Contact Your Bank: Immediately notify your bank or credit card company about any fraudulent transactions. They may be able to freeze your account and prevent further unauthorized charges.

– Place a Fraud Alert or Credit Freeze: Contact the three major credit bureaus—Equifax, Experian, and TransUnion—to place a fraud alert or freeze on your credit. This makes it harder for thieves to open accounts in your name.

– Report to the Authorities: File a report with the Federal Trade Commission (FTC) via IdentityTheft.gov. If necessary, report the theft to your local police as well.

– Monitor Your Accounts: Keep a close eye on your bank, credit card, and credit report to detect any further signs of fraud.

How Identity Theft Protection Can Help

The best way to prevent identity theft from causing serious damage is to stay proactive. Identity theft protection services offer continuous monitoring and quick alerts, helping you respond to potential issues as soon as they arise. These services often go beyond just credit monitoring by including comprehensive recovery support if your identity is stolen.

With Identity Theft Protection, you can enjoy peace of mind, knowing that you’re actively guarding your personal information. If you suspect your identity has already been compromised, our team is here to help guide you through the recovery process and get you back on track.

Get HelpGet Help

Legal Briefs Turned Breach Fodder

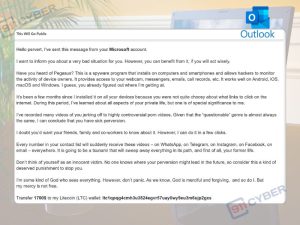

🚨 SCAM ALERT: “This Will Go Public” Email – Here’s What You Need to Know

Spot and Avoid EZPass Toll Payment Scams

Beware of EBT Scam Texts

Lost Access to Social Media Accounts?